The retail landscape in Asia Pacific (and globally) continues to undergo transformation, mostly driven by consumers, and for companies — particularly e-commerce organizations — the challenge is how to provide a unified shopping experience.

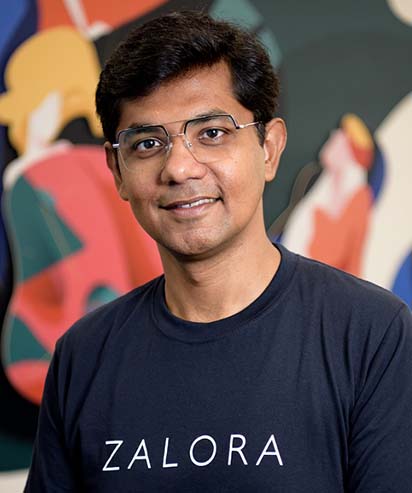

In this Q&A, Achint Setia, Chief Revenue and Marketing Officer, Zalora, shares insights on the latest consumer trends, as well as ZALORA’s e-commerce and marketing strategies, leveraging offline and online experiences, AI and loyalty programs.

What are the challenges that online/e-commerce companies face today? Is it more personalization or is it more the overall consumer experience?

Setia: The retail landscape is undergoing a significant transformation, driven by consumers’ increasing agility in navigating between online and offline environments.

This shift has led to the diversification of the retail omnichannel ecosystem, where brands must now strike a delicate balance between providing a unified shopping experience across all their channels while also offering personalized and engaging experiences that cater to individual preferences.

Last year’s ZALORA TRENDER report highlights the growing demand for humanized and personalized shopping journeys as consumers continue to adapt to the e-commerce landscape.

This emphasizes the importance of ‘experience’ in retail, requiring businesses to recognize that consumers spend a significant portion of their time online. Offline channels, therefore, must offer unique and engaging encounters that complement the online experience.

Achieving this balance requires businesses to invest in understanding consumer behavior across all channels, leveraging data analytics to gain insights into preferences and purchase patterns.

This understanding can then be used to create personalized experiences that seamlessly transition between online and offline interactions, basically creating wow moments for them that are anchored on the brand experience.

Businesses must also embrace innovation to enhance the shopping experience.

“Shoppertainment,” the concept of gamifying the shopping experience, is one such innovation that can captivate consumers and foster brand loyalty. We’re also seeing this in live selling which has a growing popularity in Southeast Asia and enabled an offshoot of e-commerce, another adjacent channel – social commerce. Additionally, businesses can utilize augmented reality and virtual reality technologies to create immersive experiences that allow consumers to virtually try on products or explore store layouts before making a purchase.

In an increasingly crowded marketplace online and offline, how can brands and retailers gain, and hold onto the attention and loyalty of shoppers?

Setia: Brands and retailers must find new and engaging ways to keep customers excited. With online sales continuing to grow post-pandemic, Southeast Asian consumers are expecting faster delivery speeds, reliability, convenience and ease of returns when they shop online.

This means that brands need to ensure that their logistics, payment, and delivery infrastructures are able to meet the burgeoning demand. In addition to providing a seamless digital shopping experience, retailers and e-commerce platforms are also introducing attractive perks and services and value-added benefits to delight and excite customers, and more importantly, build and maintain brand loyalty, which remains a marketing imperative even as it gets more challenging today.

What are the trends that you see in Asia-Pacific when it comes to companies such as ZALORA and its competitors?

Setia: Firstly, Asia’s e-commerce scene remains a bright spot, despite consumers cutting back on discretionary spending in the face of rising inflation – this is due to a growing middle class and continued digitalization across the region. Another critical contributing factor is the success of shopping festivals, in particular double-digit campaign days.

Secondly, to cater to the continued growth of e-commerce in the region, we have leveraged AI technologies to help drive better efficiencies in our operations, improve the online fashion customer experience, and further unlock growth opportunities.

We recently launched our own Platform-as-a-Service integration of OpenAI, called TITAN, and the first set of areas powered by TITAN includes Smart Search Discovery, Conversational Shopping Assistant, Production Automation, Internal Chatbots, and Warehouse Management System.

Last but definitely not least, is the need to protect the privacy and safety of customer data.

On the flip side, what are the consumer trends that you see when it comes to e-commerce in the region?

Setia: Consumer behavior has undergone a significant transformation since ZALORA’s inception. Today’s shoppers are more discerning and selective in their spending, prioritizing high-value purchases from established brands while also exploring emerging labels. Sustainability has emerged as a key consideration, with consumers, particularly millennials and Gen Zs, gravitating towards eco-conscious options.

Consumers demand a seamless shopping experience that transcends the boundaries between online and offline platforms.

Last year’s TRENDER report uncovered another key trend – the continued expansion of digital financial services in Southeast Asia. Four out of six regional markets actively utilize cashless payments. Buy-Now-Pay-Later (BNPL) payments have skyrocketed across the region, with a 226% increase in central areas and a 190% increase in the outskirts from 2021 to 2022, as per our TRENDER data.

Given that over 70% of Southeast Asia’s population remains unbanked or underbanked, offering alternative digital payment methods can enhance financial accessibility and inclusion for millions in the region while opening up new avenues for online retailers.

As the e-commerce landscape matures, the focus shifts from customer acquisition to retention.