UOB hopes to revolutionise banking with its commitment to an omnichannel experience, strategic acquisitions, and Al-driven personalisation.

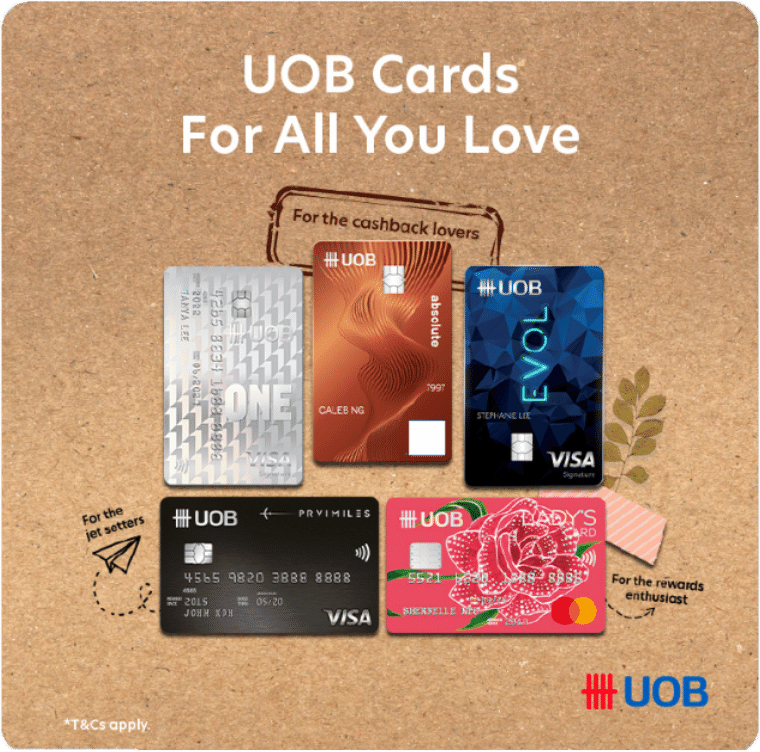

UOB‘s leadership in Singapore is evident, as seen through its sustainable and stable financial performance, which is positioned for continued long-term growth. This is reinforced by its market-leading performance and achievements, led by its cards, wealth, deposits, and secured loans businesses.

Last year, UOB rolled out a brand revitalisation campaign, reaffirming its brand promise and commitment to delivering personalised banking experiences through an omnichannel approach.

Expanding opportunities while delighting customers

UOB’s acquisition of Citigroup’s retail businesses in Indonesia, Thailand, Malaysia, and Vietnam doubled its retail customer base and prompted a digital engagement focus to ensure a seamless and positive onboarding experience for Citigroup customers, most of whom are digitally active.

Having an increased presence in the four ASEAN markets has also paved the way for UOB’s larger customer base across the region to enjoy more perks and privileges suited to their unique lifestyles and needs via partnerships with renowned brands.

UOB cardholders in ASEAN can enjoy cross-border offerings via partnerships with top brands in travel, dining, and retail across the region, including exclusive wine-pairing dinners and gala dinners by Michelin-starred chefs. This is part of wine-rating authority Robert Parker’s partnership with the financial institution.

Britain’s top designer, Paul Smith, is also among the bank’s collaborators. With this being Smith’s first partnership with UOB, his signature designs will be reflected on merchandise exclusive to UOB cardholders in spend-and-get campaigns.

In terms of travel offers, UOB’s one-stop portal, the Travel Insider, will bolster its range of curated deals by offering more than 1,000 deals worldwide, including tie-ups with major malls, retail franchises, and restaurant chains.

AI/ML for customer-centric personalisation

UOB’s omnichannel strategy centres on clients’ preferred engagement, meaning anticipating their needs, gaining deeper insights into their goals, and prioritising customer access to expertise 24/7, digitally or in-person.

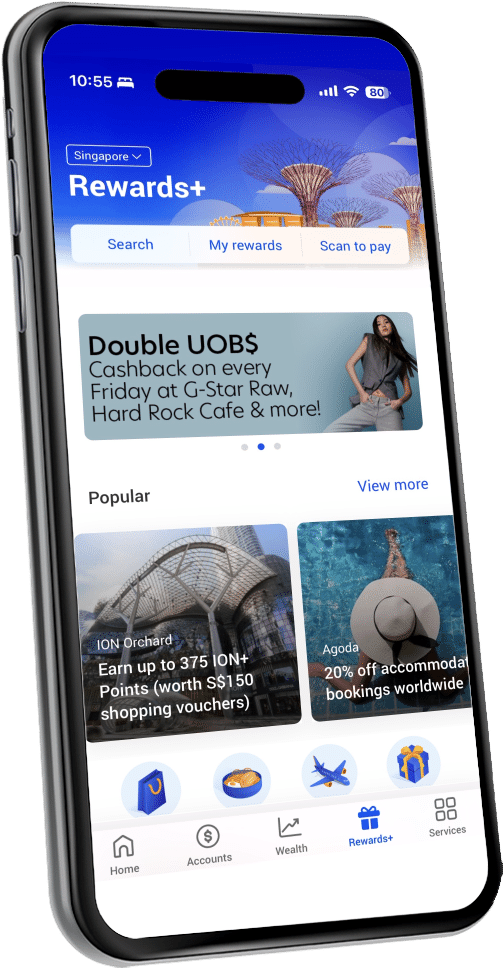

Enabling this strategy is UOB TMRW, an all-in-one banking app that is built around customers and their needs. UOB TMRW focuses on making banking simple and engaging for customers, whatever their banking needs may be. The app also gives customers access to Mighty FX, where they can get great exchange rates on foreign currency conversions for travel, online shopping, or investments.

Through the UOB TMRW app, customers get personalised, Al-driven insights created around their habits and preferences, offering them recommendations and nudging them to make better financial decisions. Customers also enjoy UOB Rewards+, Singapore’s biggest card rewards programme offering exclusive deals, cashback, coupons, and rewards all year round.

The UOB TMRW app also gives customers access to UOB SimpleInvest, where they can choose from curated portfolios based on various goals and risk appetites. Customers can also tap on insights and research from the UOB Private Bank Chief Investment Office with the Income and Growth portfolios.