Economic seasonal factors and an unusually high rate of expenditure in 2022 have resulted in online advertising expenditure slightly declining, reports IAB.

Economic seasonal factors and an unusually high rate of expenditure in 2022 have resulted in online advertising expenditure slightly declining, according to data released in the IAB Australia Online Advertising Expenditure Report (OAER) prepared by PwC Australia.

Total advertising expenditure for the quarter ended 31st March 2023 reached $3.426bn, an 0.8% decrease on the same quarter last year. By contrast, the quarter ending 31st March 2022 recorded an 18.5% increase.

Compared to the quarter ending March 2022, Search and directories remained resilient with 1.9% year on year growth, reaching $1.576bn, while general display reported a 2.7% decline ($1.227bn) and classifieds expenditure dropped 3.9% year on year ($623m). Video advertising outperformed general display reporting 8% growth on the comparative period.

Audio was the fastest growing category of general display advertising with a 13% increase on the comparative quarter to reach $51.9 million. Within audio, podcast increased its share of total audio expenditure by 2%, recording 20.7% year on year growth.

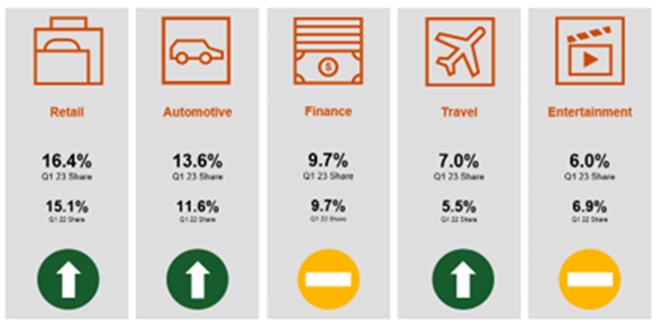

Travel entered the top five general display industry categories for the first time since December 2019, joining retail, automotive, finance and entertainment.

“It is no surprise that ad spend is back slightly on bumper levels in early 2022 with marketers taking a cautious approach, however digital investment and digital media consumption continues to outperform the rest of the media market,” said Gai Le Roy CEO of IAB Australia. “It is a delight to see the travel category share of the general display market the highest since prior to COVID, with marketing for domestic and international flights and destinations targeting Australians who are excited to hit the road again.”

The share of content publishers inventory bought via an agency insertion order continued to increase reaching 48% for the quarter, while inventory purchased direct dropped slightly to 14% and the balance of inventory was bought programmatically (guaranteed deals and RTB/PMP).